option arbitrage calculator|Options Arbitrage Opportunities via Put : Manila We have prepared this put-call parity calculator for you to understand the relationship between a call and put option. It will also help you to understand how . Discover the Best $300 FREE CHIP Bonuses NO DEPOSIT REQUIRED Play At Trusted Online Casinos for Free Latest Coupon Codes for 2024 . If you want to attract new players, it’s effective to let them play the world’s most popular games for free. Popular slots available to play with $300 no deposit bonus codes include: . 200 Free Spins ; Play .

option arbitrage calculator,We have prepared this put-call parity calculator for you to understand the relationship between a call and put option. It will also help you to understand how .

Our arbitrage calculator allows you to enter the odds of two (or more) different bets to determine how much you should stake on each to guarantee a profit. If the ROI is .Our arbitrage calculator allows you to enter the odds of two (or more) different bets to determine how much you should stake on each to guarantee a profit. If the ROI is .option arbitrage calculatorPut-Call Parity Calculator: Explore put-call parity relationships for options trading. Understand options pricing accurately.Using the Black and Scholes option pricing model, this calculator generates theoretical values and option greeks for European call and put options.

This put-call parity calculator shows the relationship between a European call option, put option, and their underlying asset. By inputting information, you can see what any of .

Put-Call Parity. The equation expressing put-call parity is: C + PV (x) = P + S. where: C = price of the European call option. PV (x) = the present value of the strike price (x), discounted from.OptionStrat is the next-generation options profit calculator and flow analyzer. Through continual monitoring and analysis, OptionStrat uncovers high-profit-potential trades you . Discover in detail what is options arbitrage & how to arbitrage options, at Upstox.com. Also, learn more about its strategy, example, & calculator. The put-call parity states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa. The put-call .

Pinnacleoption arbitrage calculator Options Arbitrage Opportunities via PutDisclaimer : The SAMCO Options Price Calculator is designed for understanding purposes only. It’s intention is to help option traders understand how option prices will move in case of different situations. It will help users to calculate prices for Nifty options (Nifty Option calculator for Nifty Option Trading) or Stock options (Stock Option Calculator for .

Options Arbitrage Opportunities via Put0.114. Theta. -0.054. -0.041. Rho. 0.041. -0.041. Using the Black and Scholes option pricing model, this calculator generates theoretical values and option greeks for European call and put options. An arbitrage calculator makes identifying arbitrage opportunities across various sports betting markets and betting sites effortless. . You will find that arbitrage calculators can help you cut down on the time and effort required to find decent arbitrage options. This is because they automatically calculate the optimal size for your bets for . 6.4 – The Options arbitrage. Arbitrage opportunities exist in almost every market, one needs to be a keen observer of the market to spot it and profit from it. . You are calculating profit/loss at various levels of nifty expiry. In scenario one you are calculating 227 as loss. whereas in case of future the loss would be 189. In scenario 2 .

An call option's Value at expiry is the amount the underlying stock price exceeds the strike price. The Profit at expiry is the value, less the premium initially paid for the option.. Value = stock price - strike. Profit = (value at expiry - option cost) × (number of contracts × 100) _____ = ((stock price - strike) - option cost) _____ × (number of contracts × 100)

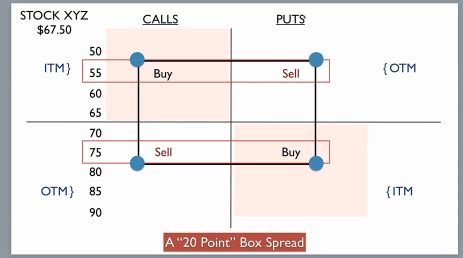

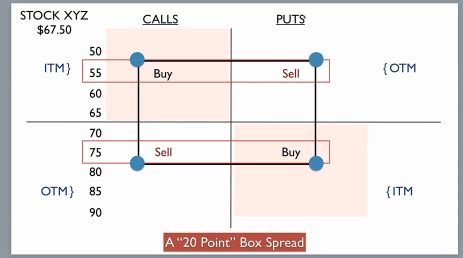

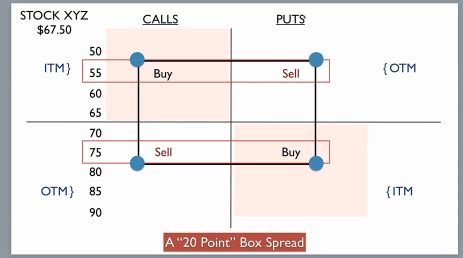

Use our options profit calculator to easily visualize this. To find the breakeven, simply add the price you paid for the contract (s) to the strike price: breakeven = strike + cost basis. Calculate potential profit, max loss, chance of profit, and more for long call options and over 50 more strategies. Breakeven Point. Box Spread (also known as Long Box) is an arbitrage strategy. It involves buying a Bull Call Spread (1 ITM and I OTM Call) together with the corresponding Bear Put Spread (1 ITM and 1 OTM Put), with both spreads having the same strike prices and expiration dates. The strategy is called Box Spread as it is combination .Option Arbitrage Opportunities: Option Arbitrage trades are performed to earn small profits with less or zero risk. It is a process of buying and selling an equivalent commodity in two different markets. Options arbitrage can be done through put-call parities. A call gives you the rights to purchase and put gives you the rights to sell.

option arbitrage calculator|Options Arbitrage Opportunities via Put

PH0 · Put

PH1 · Pinnacle

PH2 · Options Profit Calculator with Optimizer and Flow

PH3 · Options Arbitrage Strategies & How to Arbitrage Options

PH4 · Options Arbitrage Strategies

PH5 · Options Arbitrage Opportunities via Put

PH6 · Option Price Calculator

PH7 · Arbitrage Calculator: Calculate how to guarantee a profit